On-chain data shows the Bitcoin taker buy/sell ratio has been unable to give any real signal recently as the demand has remained low in the market.

Bitcoin Taker Buy/Sell Ratio Hasn’t Been Able To Catch Any Momentum Recently

As pointed out by an analyst in a CryptoQuant post, the taker buy/sell ratio hasn’t moved much above or below 1 since August 2022. The “Bitcoin taker buy/sell ratio” is an indicator that measures the ratio between the taker buy volume and the taker sell volume.

When the value of this metric is greater than one, it means the buy or the “long” volume is higher in the market right now. Basically, this means that there are more buyers willing to purchase BTC at a higher price currently, and thus the buying pressure is stronger.

On the other hand, values of the indicator under the threshold suggest the taker sell volume is more dominant at the moment. Such values imply a bearish sentiment is shared by the majority of the investors currently.

Naturally, the ratio being exactly equal to one indicates the taker buy and taker sell volumes are exactly equal right now, and therefore the market is evenly split between bullish and bearish mentalities.

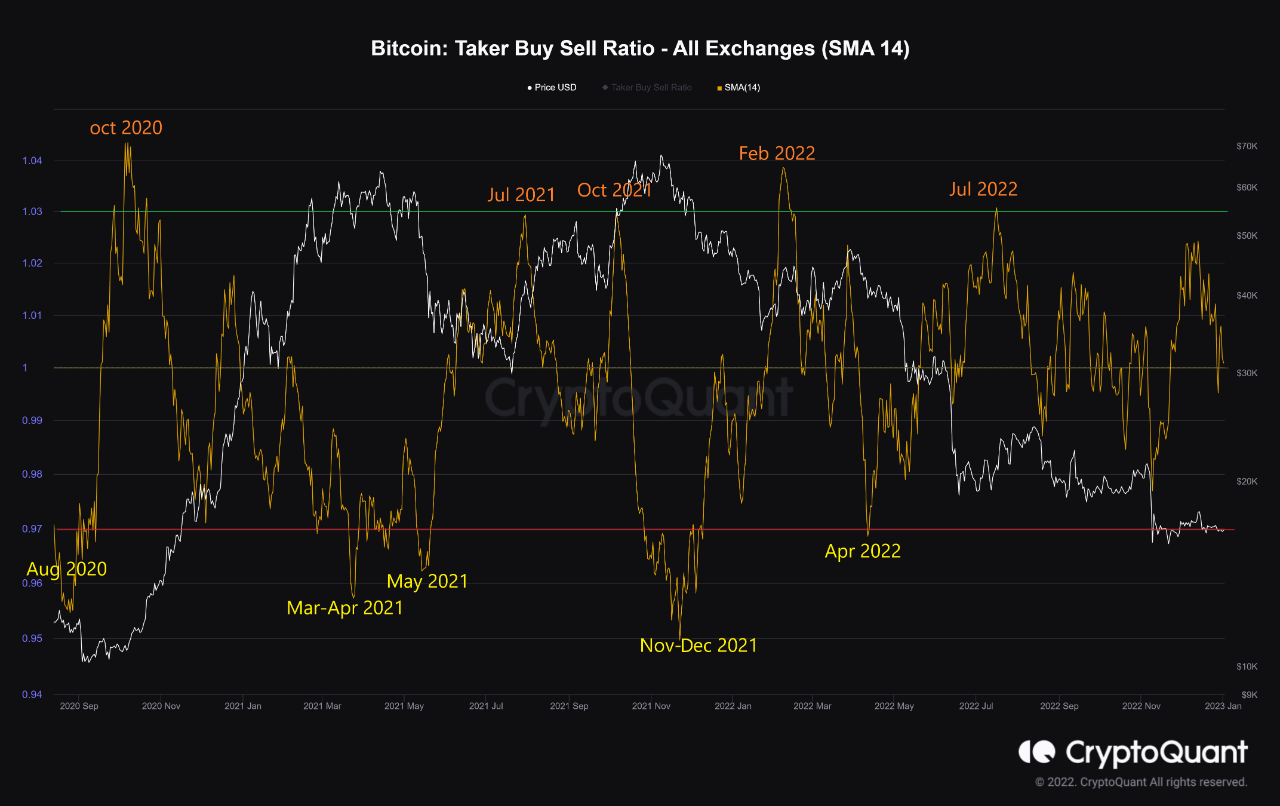

Now, here is a chart that shows the trend in the 14-day simple moving average (SMA) Bitcoin taker buy/sell ratio over the last few years:

The 14-day SMA value of the metric seems to be close to 1 at the moment | Source: CryptoQuant

As you can see in the above graph, the quant has marked the relevant points of the trend for the 14-day SMA Bitcoin taker buy/sell ratio. It looks like whenever the indicator has crossed the 1.03 level, BTC has observed some bullish momentum shortly after.

On the contrary, whenever the ratio dipped below the 0.97 level, a bearish trend followed the crypto’s price. The last time this signal formed was back in April 2022, before the market observed the LUNA and 3AC collapses.

The bullish signal was last seen in July 2022, as the crypto built up towards its first relief rally of the bear market. Since then, however, there have been no other breaches of either of these levels, as is apparent from the chart.

In the period between then and now, the taker buy/sell ratio has been oscillating around 1, but the metric has just not been able to summon enough momentum to go all the way in either direction. “We cannot anticipate Bitcoin to move much as long as confidence – and subsequently demand – does not return to the market,” explains the analyst.

BTC Price

At the time of writing, Bitcoin is trading around $16,700, down 1% in the last week.

Looks like the value of the crypto has observed a small surge in the last 24 hours | Source: BTCUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com