A pump and dump crypto scheme is one of the most common forms of manipulation in crypto markets. It targets new or inexperienced traders by creating the illusion of a fast-growing investment opportunity. Prices rise quickly, the news spreads, and then the value collapses just as fast. In this article, we will learn how pump and dump schemes work and help you avoid falling victim to them.

What Is a Pump and Dump?

A pump and dump in crypto is a fraudulent practice where a group of malicious actors artificially inflates an asset’s price and then sells it for profit. During the pump phase, promoters usually hype a new or relatively worthless token with exaggerated claims, driving sudden price spikes and attracting unsuspecting investors. Once the price peaks, they trigger the dump phase—a massive sell-off that causes sharp price decreases, leaving others holding nearly worthless tokens.

The Mechanics of a Pump and Dump Scheme

A pump and dump scheme in crypto usually follows a predictable pattern. The goal stays the same every time: create artificial demand, raise a token’s price, then sell at a significant profit. These phases are designed to pull in more potential victims as the scheme progresses.

Phase 1: Pre-Pump (Accumulation)

In the pre-pump phase, organizers quietly buy large amounts of a token. It’s usually a new token or one without utility, that seems to present no possibilities for investors. They often use multiple accounts to hide their holdings and avoid detection. At this stage, the token’s liquidity is low, which makes price manipulation easier.

Phase 2: Pump (Artificial Inflation)

Next comes the pump phase, where promoters flood social media posts with exaggerated claims and “get rich quick” promises. This coordinated hype creates sudden price spikes as demand surges in crypto markets. As a result, the asset’s price becomes artificially inflated, drawing in unsuspecting investors who believe they’ve found a real investment opportunity.

Phase 3: Dump (Profit-Taking)

During the dump phase, early buyers sell their holdings all at once. This massive sell-off causes the token’s price to collapse within minutes or hours. Late buyers are left holding nearly worthless tokens as the value drops sharply and liquidity disappears.

Some Real-Life Examples

Pump and dump schemes aren’t theoretical—they show up in the news whenever tokens suddenly rise and crash, leaving many investors with losses. And that happens quite often. In late 2025, a federal lawsuit accused the creators of the $MELANIA and $TRUMP memecoins of running a pump and dump, when prices first spiked quickly and then collapsed, allegedly enriching insiders at the expense of others.

Another recent case involved a fake WIRED memecoin promoted through a compromised social media account. Hackers used the account to create hype, then executed a rapid sell-off that crashed the token’s price within minutes, illustrating how social media tactics help orchestrate these schemes in crypto markets.

Beyond individual coins, viral tokens driven by social media, like $HAWK, have also experienced dramatic pump and dump–like behavior, with market caps ballooning before steep declines shortly after launching.

How to Get Free Crypto

Simple tricks to build a profitable portfolio at zero cost

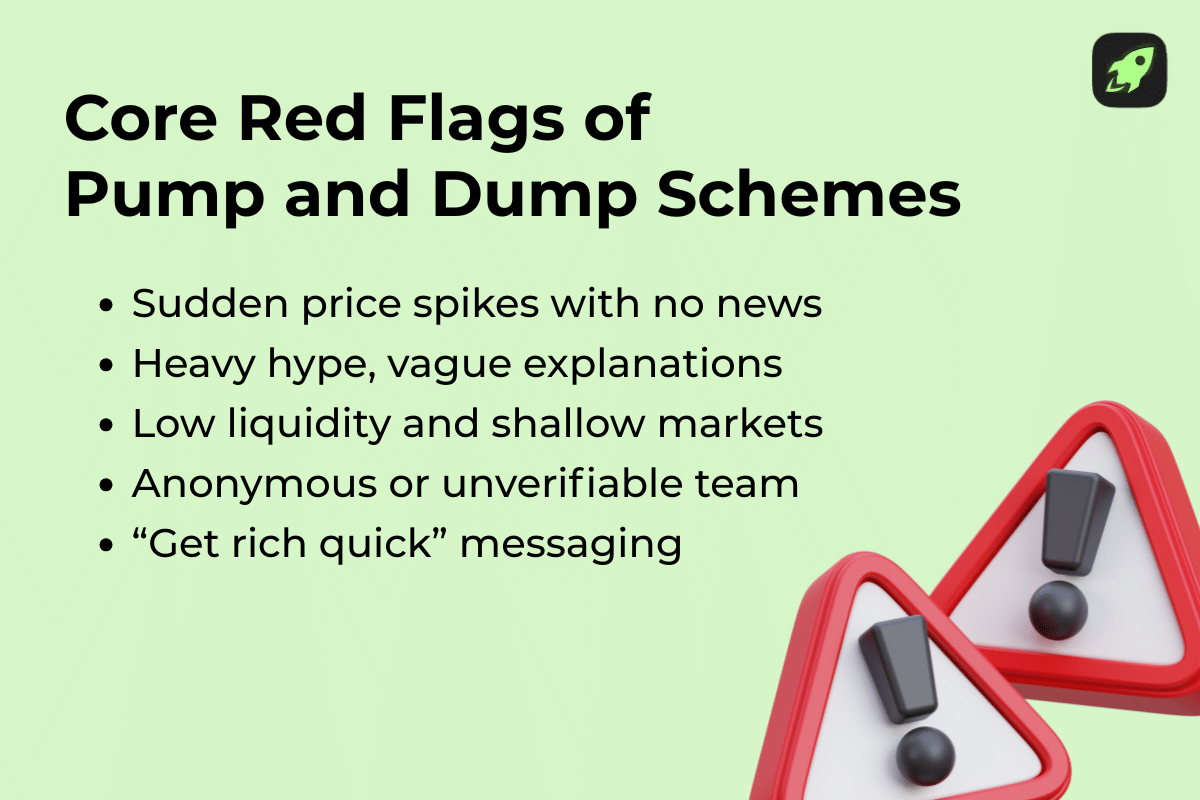

How to Identify Red Flags

You can often spot a pump and dump scheme early if you pay attention to common warning signs. These red flags can help you make an informed decision when it comes to new or excessively promoted tokens.

- Lack of Regulation

Many pump and dump crypto schemes operate outside clear regulatory oversight. Crypto markets offer fewer protections than traditional financial markets or the stock market, and scammers actively exploit that. - Unusual Price Movements

Sudden price spikes with no supporting news, product updates, or data often signal artificial demand. These moves usually appear during the pump phase and reverse quickly.

Learn more about market cycles.

- Anonymity

Projects with anonymous developers or no verifiable background increase risk. When no one is accountable, organizers can easily disappear after the dump. - Low Liquidity

Tokens with low liquidity are easier to manipulate. Small buy or sell orders can cause large price changes, making massive sell-offs more damaging. - Aggressive Marketing

Heavy promotion through social media posts, exaggerated or unsupported claims, and “get rich quick” language targets unsuspecting investors. Legitimate projects focus on transparency and utility.

How to Protect Yourself

You can reduce the risk of getting involved in pump and dump schemes by following a few practical rules. These steps help you make informed investment decisions and avoid emotional trades.

- Always DYOR: Do Your Own Research

Never rely on promotion or social media posts alone. Research the project, its development team, the token’s supply, and its real use cases before you invest. - Use Reliable Coin Trackers

Track token price, trading volume, and historical data using trusted platforms. Consistent data helps you spot sudden price spikes that don’t match real demand. - Check Trading Volume and Liquidity

Low liquidity makes price manipulation easier. If small trades cause big price moves, the asset carries higher risk. - Join Safe, Reputable Crypto Communities

Established communities focus on education and transparency instead of making promises they can’t fulfill. These spaces can help you spot red flags early and avoid misleading information.

Role of Social Media & Influencers

Social media and influencers play a dual role in pump and dump crypto schemes: they often fuel interest, but they also help expose manipulation after the fact. During a crypto pump, promoters rely on social media posts, private groups, and influencer shoutouts to spread their claims and trigger fear of missing out (FOMO). In some cases, accounts are even hijacked to push fake tokens. In the example above, hackers used a journalist’s X account to promote a fake WIRED token.

Influencers can also amplify pump and dump schemes without fully understanding the project. The Save the Kids token, promoted by several gaming influencers, collapsed shortly after launch when insiders sold large holdings, leaving other investors with nearly worthless tokens.

At the same time, however, social media can also help uncover dump schemes. Analysts and journalists track sudden price spikes, low liquidity, and on-chain data, then publicly flag false information. That’s why following credible researchers can help you spot pump and dump schemes early and avoid becoming a victim.

Are Pump and Dumps Legal?

In many jurisdictions, pump and dump schemes are illegal, because they involve market manipulation and deception with the goal of profiting at the expense of investors. In the US, regulators such as the Securities and Exchange Commission (SEC) and the Department of Justice treat these schemes as violations of securities laws, either when they involve assets classified as securities, or otherwise mislead investors. The SEC actively pursues fraud and market manipulation cases tied to cryptocurrency and other assets.

A growing number of high-profile legal actions demonstrate this point. In 2025, a sweeping class action lawsuit accused Pump.fun, Solana Labs, and Jito Labs of orchestrating a coordinated “pump enterprise” that allegedly violated US securities and racketeering laws by extracting billions from retail crypto traders via artificial price inflation and dumping.

Another example involves private legal action against the Solana-based M3M3 token launch, where plaintiffs allege the defendants artificially inflated the token’s price and dumped their supply for profit, causing significant losses for later buyers.

Even in the relatively unregulated world of crypto markets, legal liability exists when schemes resemble traditional market manipulation, and authorities are increasingly treating deceptive trading tactics in the industry as unlawful.

Final Thoughts

Pump and dump schemes rely on speed and emotion. They exploit low liquidity, unrealistic claims, and fear of missing out to move a token’s price in a short time window. While these tactics may look similar to behavior seen in traditional financial markets, crypto markets make manipulation even easier due to lower oversight and faster information spread.

That’s why research plays a crucial role. If you understand the mechanics, recognize red flags, and slow down before you invest, you reduce the risk of becoming one of the many investors left holding a worthless token.

FAQ

How long does a pump and dump usually last?

Most pump and dump schemes move quickly. The pump phase can last minutes or hours, while the dump often happens almost instantly once early buyers sell large amounts.

Can pump and dump schemes happen in traditional markets?

Yes. Similar schemes have existed in traditional markets for decades, especially with penny stocks on Wall Street. Crypto markets face higher risk because tokens launch faster and oversight is weaker.

How can beginners avoid pump and dump crypto schemes?

You can avoid falling victim by doing your own research, checking liquidity and trading volume, questioning exaggerated claims, and avoiding “get rich quick” messaging. Slowing down is often the best defense.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.