Fear of missing out (FOMO) and panic selling ruin many crypto trades. But there’s a better way to make decisions. Learning what RSI is in crypto gives you a simple, data-backed tool to avoid emotional trades. This article shows you exactly how to use the Relative Strength Index (RSI) in crypto trading, so you can spot momentum shifts, avoid bad entries, and make smarter trading moves.

What Is the Relative Strength Index (RSI)?

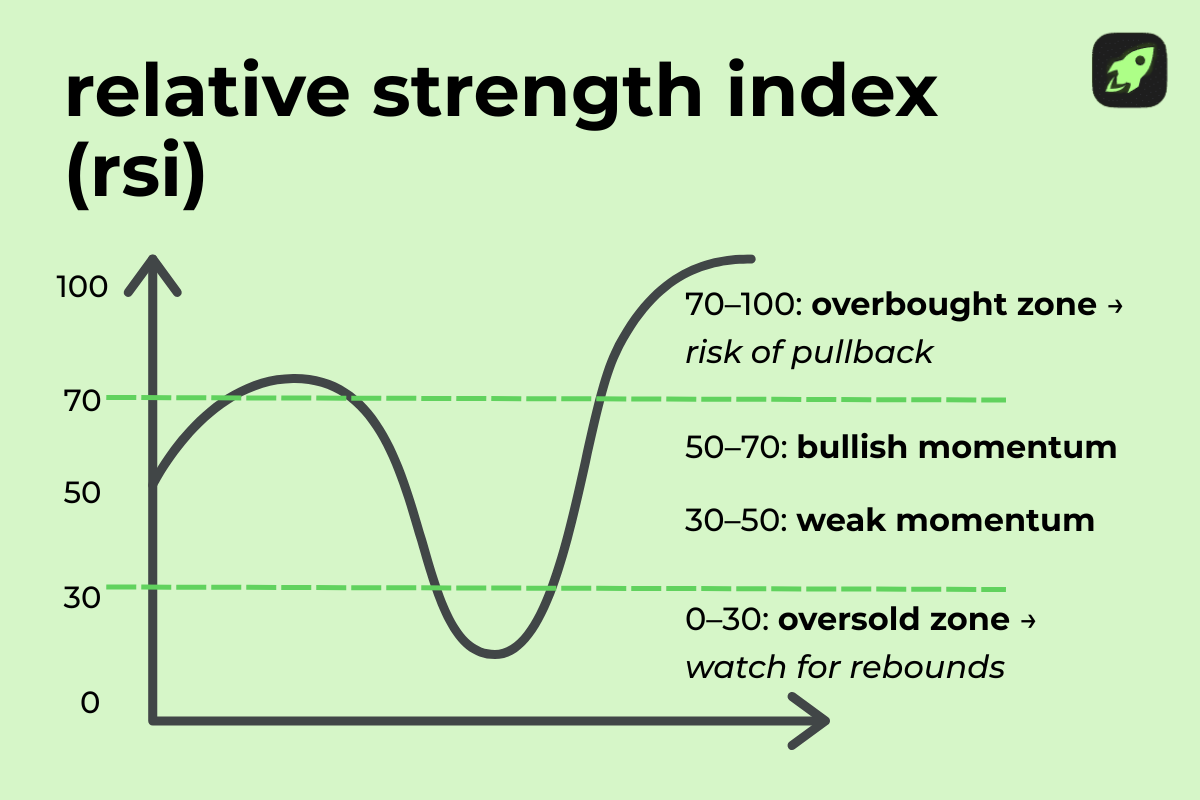

The Relative Strength Index (RSI) is a momentum oscillator that compares recent price gains and losses to measure an asset’s relative strength. It tracks how fast and how far prices move, showing whether buyers or sellers are dominating the market at a given time. On a chart, the RSI stands as a single line that fluctuates between 0 and 100. When the line moves higher, it means average gains outweigh losses; when it drops, selling pressure is in control.

The standard RSI interpretation is simple: readings above 70 suggest the asset may be overbought and due for a pullback, while readings below 30 suggest it could be oversold and set for a bounce. Some traders adjust these thresholds depending on the market trend or volatility.

The RSI Indicator Across Markets

J. Welles Wilder developed the Relative Strength Index (RSI) in 1978, publishing it in his book New Concepts in Technical Trading Systems. Since then, it has become one of the most popular indicators in both traditional and crypto markets. Wilder also applied smoothing to both average price gains and losses, so RSI rarely reaches 100 or 0.

In crypto trading, RSI is used exactly as in stocks or forex: to gauge momentum and confirm trends. When RSI rises sharply, it signals strong buying activity; when it falls, momentum is weakening. Many traders add RSI to their charts to check if a rally is gaining real strength or losing steam. It’s a visual, easy-to-read tool that plays a key role in technical trading systems, helping crypto traders time entries, exits, and trend confirmations.

Calculating RSI: The Relative Strength Index Formula Explained

The RSI formula compares average gains to average losses over a set number of periods, usually 14. This calculation helps you measure recent price changes and determine momentum. The formula is:

RSI = 100 – [100 ÷ (1 + RS)]

Here, RS is the ratio of average gain to average loss during the chosen period. If prices mostly go up, RS increases, pushing RSI higher. If prices mostly fall, RS drops, and RSI moves lower.

Let’s break it down with an example.

Say Bitcoin rises on 10 of the last 14 days, averaging a 1% daily gain, and falls on 4 days, averaging a 0.5% daily loss. RS = 1 / 0.5 = 2. Plug that into the formula:

RSI = 100 – (100 / (1 + 2)) = 66.7

This result shows moderate bullish momentum.

Most traders use a 14-period RSI, but you can adjust it however you need. A shorter look-back period (like 7 or 9) makes RSI more responsive to recent moves, which is useful for fast crypto markets. A longer period (like 21) smooths out noise, better for long-term trends.

Many modern trading platforms calculate RSI automatically, but understanding the RSI calculation gives you more control.

RSI Value Scale: 0–100

RSI values range from 0 to 100, helping you measure momentum extremes. The standard overbought and oversold levels are 70 and 30. Readings above 70 signal an asset is overbought, meaning it might be overheated and due for a correction. Readings below 30 suggest it’s in oversold territory, where selling pressure could fade and buyers step in.

These RSI ranges are guidelines, not strict rules. In crypto bull markets, traders sometimes shift overbought or oversold territory to 80/40 to avoid false signals. In bear markets, they might adjust it to 60/10.

For meme coins or small-cap tokens, RSI spikes happen often, so be cautious. Strong trends can keep RSI in extreme zones for long periods without reversing.

Use oversold levels and overbought warnings as alerts, not trade commands. They can help you spot potential exhaustion points, but always confirm with price action or other tools before acting.

How Do You Read the RSI?

The RSI indicator shows you how momentum shifts over time. When it rises, buyers are in control. When it falls, sellers dominate. Reading RSI is about understanding RSI behavior in relation to market momentum, it’s not just meaningless numbers. Most crypto traders use RSI together with the price chart to confirm signals or spot warning signs.

4.1 Overbought and Oversold: When to Be Cautious

The most basic RSI reading is the overbought or oversold signal. When RSI moves above 70, the market is considered overbought. This suggests the asset might have risen too fast and could face a pullback. When RSI drops below 30, it signals oversold conditions, meaning heavy selling may have pushed the asset too low, too quickly.

But be careful—these are alerts, not automatic trade signals. In strong trends, RSI can stay overbought or oversold for weeks. For example, Bitcoin’s RSI stayed above 70 for most of its 2021 bull run. Knowing what happens when RSI is too high is key: price might correct, or it might keep rallying if the trend is strong.

4.2 RSI and Price Trends: Confirmation vs. Contradiction

Use RSI to confirm or challenge the trend you see on the chart. In a bullish trend, RSI usually stays in the upper half of the scale, with higher lows and consistent strength. In a bearish trend, RSI tends to stay in the lower half, reflecting seller dominance.

When price makes an upward trend but RSI makes lower highs, that’s a bearish trend divergence—a sign the rally is losing momentum. The opposite is true in a downward trend: if price makes lower lows but RSI makes higher lows, it’s a bullish signal that momentum is shifting.

4.3 Understanding RSI Reversals vs. Continuations

Many traders look for potential reversals when RSI hits extremes. But most of the time, RSI confirms the existing trend. Acting on every RSI extreme can lead to false alarms from false signals, especially in fast-moving crypto markets. Focus on reversals that align with support/resistance or patterns, not RSI alone.

4.4 RSI Crosses: Above or Below the 50 Midline

The RSI crosses of the 50-line are another key signal. When RSI moves above 50, it’s often a bullish crossover, showing positive momentum. When it drops below 50, it’s a bearish crossover, signaling sellers are gaining control.

How to Get Free Crypto

Simple tricks to build a profitable portfolio at zero cost

How to Use RSI When Trading Crypto

The RSI is one of the most popular tools in crypto trading. It works across different trading strategies, whether you’re swing trading, day trading, or long-term investing. Since crypto is known for sharp moves and extreme volatility, the relative strength index helps you time your trades better.

RSI is built into most trading crypto platforms, including Binance, Coinbase Pro, and TradingView. Using it effectively means learning not just when to buy or sell, but how to read its signals in context. The following RSI strategies cover the most common applications for crypto traders. These approaches are simple to start, but powerful when combined with technical analysis and other momentum indicators or technical indicators.

1. Entry and Exit for Your Trade

Traders often use RSI for entry signals and sell signals. When RSI dips into oversold (below 30), that can be a buying opportunity. When RSI rises into overbought (above 70), it could be time to sell or reduce exposure. For example, if Ethereum’s RSI drops to 25 after a correction, some traders buy, expecting a rebound. If RSI then rises to 75, they might exit.

Keep in mind: RSI is not perfect. In strong trends, bullish signals may happen even when RSI is high. Always use RSI together with price action to confirm your entry and exit points.

2. Swing Trading

For swing trading, RSI is a go-to tool. Swing traders try to capture short- to medium-term moves within a larger trend. RSI helps identify these swings by highlighting momentum changes. A typical trading style might involve buying when RSI crosses back above 30 after being oversold, and selling when it crosses back below 70.

This technique works well in range-bound markets, where crypto prices move between support and resistance levels.

3. Identify Support and Resistance Levels

RSI can also help you identify trends in market conditions. Sometimes RSI forms its own support or resistance, separate from the market price or asset’s price. For example, if RSI bounces off the 40 level multiple times during a rally, that 40 level becomes a momentum support zone. If RSI keeps failing to break above 60 in a downtrend, it may act as resistance.

4. Bullish and Bearish Divergence

One of the most useful RSI applications is finding bullish and bearish divergence. Spotting divergences early can help you catch trend changes before they happen.

RSI divergence occurs when price and RSI disagree. If price makes new highs but RSI makes lower highs, that’s a bearish divergence—a warning that momentum is fading.

If price makes new lows but RSI forms higher lows, that’s a bullish divergence, signaling a possible reversal.

When Can We Trust the RSI Indicator?

In crypto, RSI works best in market conditions where prices move sideways or within a range. It’s especially useful for large-cap coins like Bitcoin and Ethereum, where trends are more stable. In small-cap altcoins or meme coins, RSI can trigger false signals because of sudden volatility.

To improve accuracy, combine RSI with other indicators. For example, check moving averages to confirm the trend. Some traders also add moving average convergence divergence (MACD) for better signals. RSI is a great tool for spotting momentum shifts, but always verify it with broader market context.

Mistakes Traders Make with RSI

Many traders misuse RSI by applying it blindly or without understanding the broader market context. The relative strength index is one of the most popular tools in technical analysis, but even so, it isn’t foolproof.

Blindly Trusting RSI Overbought/Oversold Labels

One of the most common mistakes is identifying overbought or oversold RSI readings and assuming the price will instantly reverse. In theory, when RSI enters overbought or oversold conditions, it means the market may be due for a pullback or rebound. But crypto often ignores these signals, especially during strong trends.

As we mentioned, Bitcoin’s RSI stayed above 70 during its 2021 bull run for months without a major correction. In reality, overbought and oversold conditions are just warnings, not trade triggers. You should never rely solely on RSI extremes to enter or exit trades. Always look for confirmation from price action or other indicators.

Using RSI Alone Without Confluence

Another mistake is using the relative strength indicator by itself, without checking other tools. RSI measures momentum but says nothing about trend direction or market structure.

For better results, combine RSI with moving averages, support and resistance levels, or volume indicators. For example, a bullish RSI signal is more reliable if the price is also above the 200-day moving average. Confluence gives your trades a stronger foundation.

Ignoring Market Conditions (News, Events, Sentiment)

Many traders forget that RSI reacts to price movements, not fundamentals. If breaking news hits the market—a regulatory crackdown, exchange hack, or major partnership—price may move dramatically regardless of what RSI says. In crypto, market sentiment can shift fast, making momentum indicators temporarily useless. Before acting on RSI, consider news, on-chain data, and broader market events that might explain why price is moving the way it is.

Misjudging RSI Timeframes for Quick Trades

This indicator is sensitive, so the RSI period and RSI settings you choose play a huge role. Using the default 14-period RSI on a 1-minute chart will give very different results from using it on a daily chart.

When RSI falls quickly on short timeframes, it often triggers false alarms because of small price fluctuations. Adjust your settings to match your trading style: short periods for scalping, longer periods for swing or trend trading. This helps filter out noise and avoid bad entries.

Final Words

The relative strength indicator is a powerful tool for crypto traders, but it works best as part of a broader trading strategy. RSI helps you spot momentum shifts, confirm trends, and time entries or exits with more confidence. Remember, no indicator is perfect—use RSI with confluence, adjust your settings for your trading style, and stay aware of market conditions. With practice, RSI becomes a key ally for navigating crypto’s fast-moving price cycles.

FAQ

What is a good RSI to buy?

A “good” RSI to buy typically happens when the indicator moves from oversold back toward neutral. Many traders start watching for entries when RSI is between 30 and 40, signaling the market is recovering from a dip. However, in some cases, traders wait for RSI to break specific levels depending on the asset’s trend. Always confirm with price action or support levels before buying.

What does RSI tell you?

RSI is a relative strength indicator that shows whether buyers or sellers are dominating the market. It tracks the balance between recent gains and losses, giving you a view of market momentum. When RSI rises, buying pressure is strong. When it falls, selling pressure dominates. RSI helps you identify if an asset is trending, ranging, or reaching an extreme that could lead to a reversal or pullback.

What happens when RSI is too high?

When RSI rises too high—usually above 70—the asset enters overbought and oversold zones. This warns that buying momentum might be unsustainable, and a pullback could follow. However, in strong uptrends, RSI can stay elevated for weeks without a reversal. Always combine RSI with trend analysis or support/resistance levels to avoid exiting too early or falling for false reversal signals.

Can RSI be used effectively in highly volatile crypto markets like meme coins or low-cap altcoins?

Yes, but with caution. In highly volatile markets, RSI often gives whipsaw signals because of rapid price swings. Meme coins and low-cap altcoins may hit extreme RSI readings frequently without meaningful reversals. To use RSI effectively here, widen your thresholds—for example, treat 80/20 as overbought/oversold instead of 70/30—and confirm with other indicators like volume or trend lines before trading.

What’s the best RSI timeframe for crypto trading?

The best RSI timeframe depends on your strategy. Day traders often use shorter RSI periods, like 7 or 9, for quicker signals. Swing traders stick to the classic 14-period RSI on 4-hour or daily charts. For long-term trends, some use 21-period RSI to smooth out market noise. Always adjust your RSI settings to match your trading style and the asset’s volatility.

How reliable is RSI during strong trends (bull runs or crashes)?

In strong bull runs or crashes, RSI is less reliable for spotting reversals. It often stays in overbought territory during rallies or remains oversold in crashes. This happens because momentum remains one-sided. Instead of using RSI to predict tops or bottoms in trends, focus on the 50-line crosses or use RSI to confirm the trend’s strength. This reduces the risk of trading against market momentum.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.